Parents, our goal is to minimize our Expected Family Contribution so that we can maximize our chance of receiving financial aid.

So, how exactly do we do that?

To determine your Expected Family Contribution, or EFC, a college’s Financial Aid Office will look at income and assets – yours and your child’s. They will weigh income more heavily than assets.

How Income is Treated

Parents will be expected to devote 22-47% of their annual income to college costs. (And, heads up, salary deferrals to employer-sponsored retirement plans and contributions to IRAs, SEPs will get added back into your income.) Students will be expected to contribute more – 50% – of their own earned income. (How’s that for punishing a kid for getting a paid job during the summer or after school? Sheesh!) What’s more, colleges take a two-year “look back” on income, meaning that if you’re applying for financial aid for the 2019/20 academic year, they will look at your and your student’s income in 2017 and 2018.

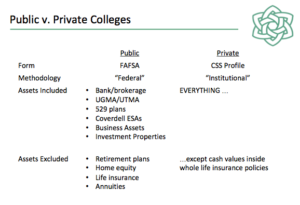

How Assets are Treated Differs for Public v. Private

Whether a college includes an asset in their financial aid calculations depends on whether they are public or private. Public institutions use a form called a “FAFSA” to collect your financial information. They will include funds saved in bank or brokerage accounts; custodial UGMA or UTMA accounts; 529s and Coverdell ESAs; assets owned by a family business, and investment properties. They will, however, exclude some assets, including funds saved in 401(k)s, IRAs and other retirement plans; equity in your primary residence; cash values in whole life insurance policies and annuities you’ve purchased. Private colleges use a supplementary form called the “CSS Profile” to collect your financial data. And they basically look at everything.

It’s important to know that who owns an asset also matters when it comes to whether and how that asset gets included in financial calculations. I’ll explain in my next post.