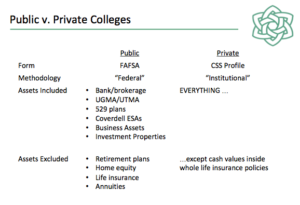

The financial aid process is a little more complicated when a student’s parents are divorced. Who is considered the “parent” for financial aid purposes? The answer differs based on whether you’re applying to a public university that uses the FAFSA or a private institution that uses the CSS.

Let’s start with schools that use the CSS because it’s simple and straightforward. Colleges consider both Mom and Dad – or both Moms or both Dads – to be “parents” for financial aid purposes. They also consider stepparents to be “parents.” They will look at the income and assets of all of them. They’ll examine retirement assets, annuities, home equity and small business assets – basically everything. (The one exception remaining is any cash value you may have in a whole life insurance policy.) Many private institutions have healthy endowments, so they still may award aid to students – but they want to paint a complete picture of all of the resources at a student’s disposal before reaching a decision on aid.

For schools using the FAFSA, who is a “parent” for financial aid purposes is more complicated.

First, parents whose divorce is not yet finalized as of the date the FAFSA is filed are still considered married for financial aid purposes, and the income and assets of both parents will be examined. Second, if a student’s parents live together – regardless of their marital status – the FA office will consider the income and assets of each.

Now, if a student’s parents are divorced, the one who is considered the “parent” for the FAFSA is the parent with whom the student lived the most in the last twelve months. If custodial time is split evenly, the parent who provided more financial support in the last twelve months is the “parent” for the FAFSA – even if that means only $1 more. (Note, it doesn’t matter which parent gets to claim the student as a dependent on their tax return.) The school using the FAFSA will then examine the income and assets of the one “parent” when determining financial aid. And, as for married parents, they will exclude from assets any retirement accounts, equity in your primary residence, annuities and the cash value in whole life insurance policies.

If, however, this “parent” has remarried, the school will also look at the income and assets of the stepparent. Fun fact. Knowing how the FAFSA ensnares stepparents, many divorced parents of high school and college aid children who are in relationships choose to delay getting married until the kids are in their final year of college!